Theory of human enterprise

Developing mathematical models of markets, innovation and organisations, so that we can predict them and enhance them through interventions.

Science has traditionally been concerned with the natural world. But as society gets more interconnected and organisations get bigger, the man-made world needs a science of its own.

The sentiment of borrowers and lenders in a financial network is what drives markets to success, but also to ruin. We develop mathematical methods to predict how distress spreads, and determine strategies to limit system-wide catastrophic failure. We determine the latent potential in countries and firms by applying spectral-like theories to their networks of products and capabilities.

Despite advances in our understanding of evolution, what drives innovation remains elusive. Technological innovation operates in an expanding space of building blocks, in which combinations of technologies become new technologies. We characterise innovation in a mathematical way, extracting concepts and conservation laws, so that we can predict and influence it.

Organisations have emergent properties and capabilities that we are just coming to terms with. The success of some wikis suggests that many non-interacting agents can produce creative works superior to what any one person could do alone. What is the mathematical basis for collective creativity, and what sectors can we apply it to? Can it be used to speed up discovery in physics and mathematics?

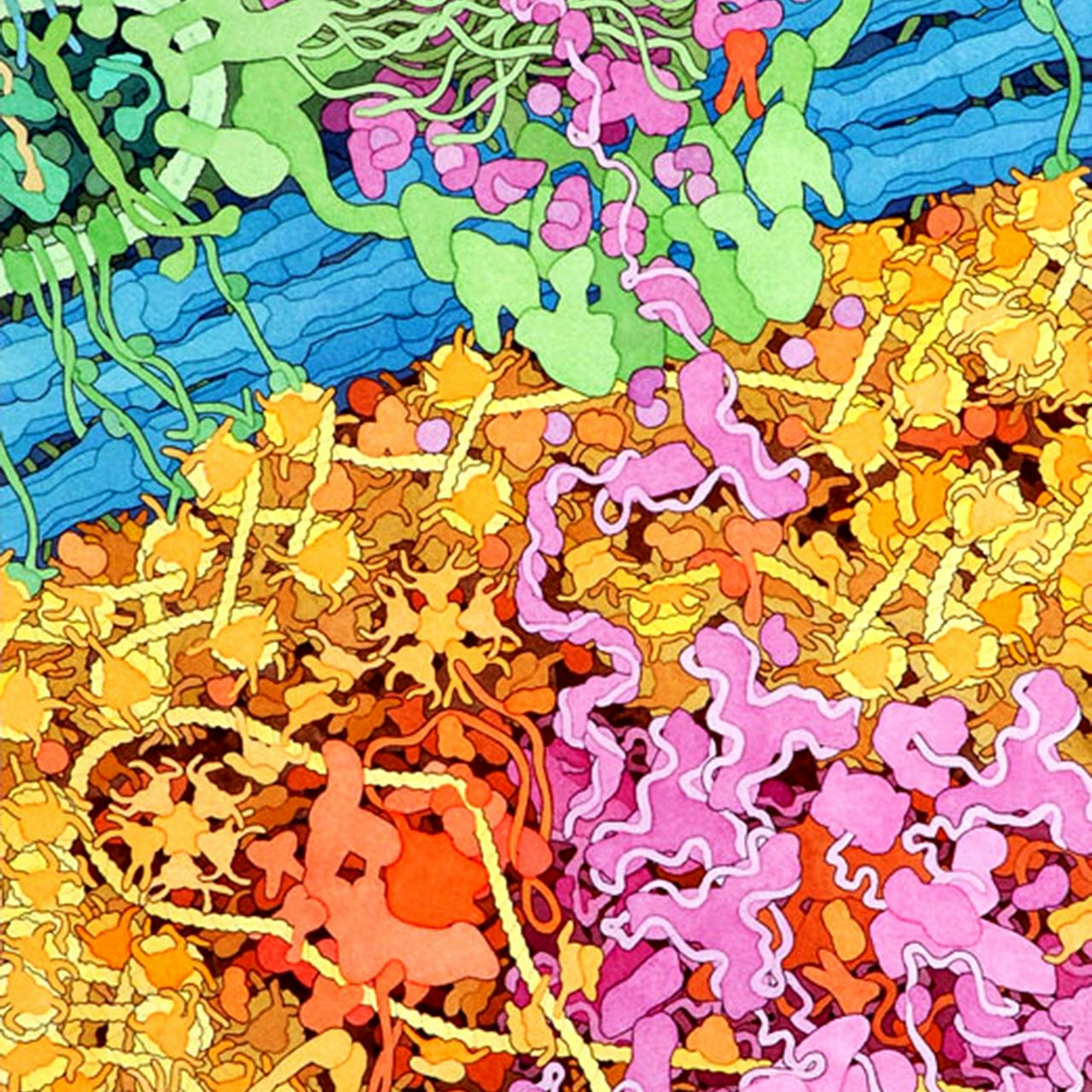

Learning the cell-state space

Building machine learning models that mimic the behaviour of cells in silico to improve the prediction of genes for cell programming.

Mathematics of immortality

Deriving the mortality equation, which governs the dynamics of an ageing population, and solving it to crack the evolutionary origin of ageing.

Informative experiment design

Developing the mathematical structure of experiments using information theory and combinatorics to speed up the discovery of new cell types.

Theory of genetic computation

Understanding genetic computation using regulatory motifs, a new kind of structural and functional building block of gene regulatory networks.

Learning the universe

Using machine learning to search the vast space of 10-dimensional geometries for ones that predict the Standard Model from string theory.

Recursively divisible numbers

Generalizing the divisor function to find a new kind of number that can be recursively divided into parts, for use in design and technology.

Fundamental advances in AI

Developing radical new approaches to inference and automated decision making using advances in quantum information and statistical physics.

The structure of innovation

Creating a mathematical model of combinatorial innovation to understand how innovation rates can be influenced as components are acquired.

Bootstrap percolation

Advancing the mathematical theory of bootstrap percolation, where active cells on a lattice with few active neighbours cease to be active.

Surprises from simple rules

Understanding complex dynamical behaviours generated by simple rules, such as cellular automata, polyominoes and models of competition.

Fractal structures

Using fractal, or self-similar, patterns to design the lightest possible load-bearing structures with new strength-to-mass scaling laws.

Structure of how things relate

Creating mathematical tools for characterizing the structure of ideal graphs and irregular networks, and the behaviour of processes on them.

Reconstructing credit networks

Using ideas from statistical physics to reconstruct the average properties of financial networks from partial sets of information.

Information thermodynamics

Understanding the physical nature of information and how it relates to energy transfer and new technologies that make use of these insights.

Spectre of hypercubes

Exploring the spectral properties of subgraphs of the hypercube and Hamming graphs for insights into coding theory and models of evolution.

Puzzles in packing

Predicting the geometry and behaviour of densely packed objects from first principles, from spheres to polydisperse spheres to cells.

Is continuous space illusory?

Creating discrete models of space and spacetime that appear continuous over long lengths and set the stage for non-continuum physics.

Remembering to learn

Understanding the dynamics of networks of memristors, a new paradigm for low-power computation inspired by the structure of the brain.

Intelligence of graphs

Predicting the behaviour of graphs and processes on them by treating topological patterns as constraints on a random graph ensemble.