Reconstructing a credit network

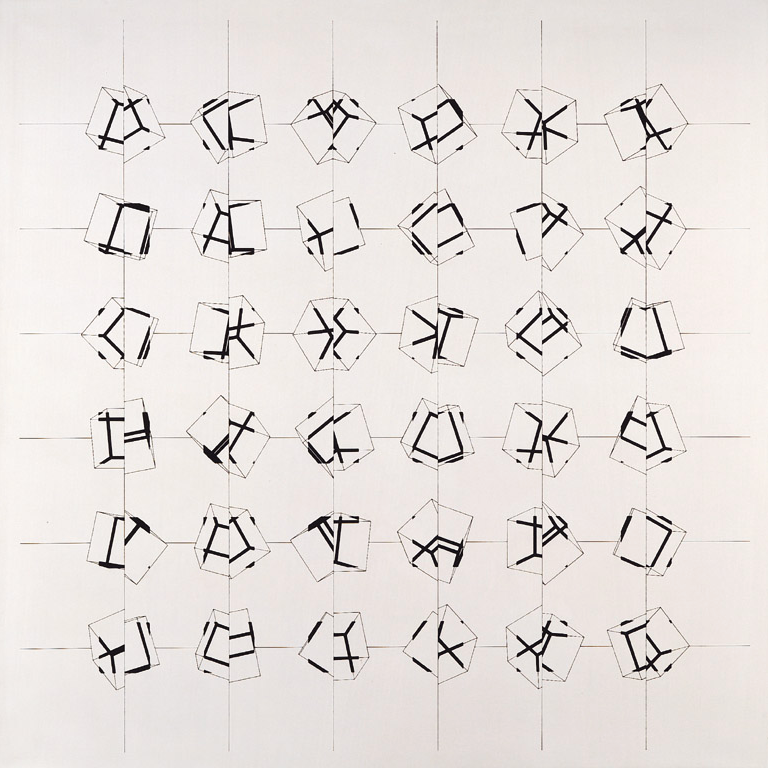

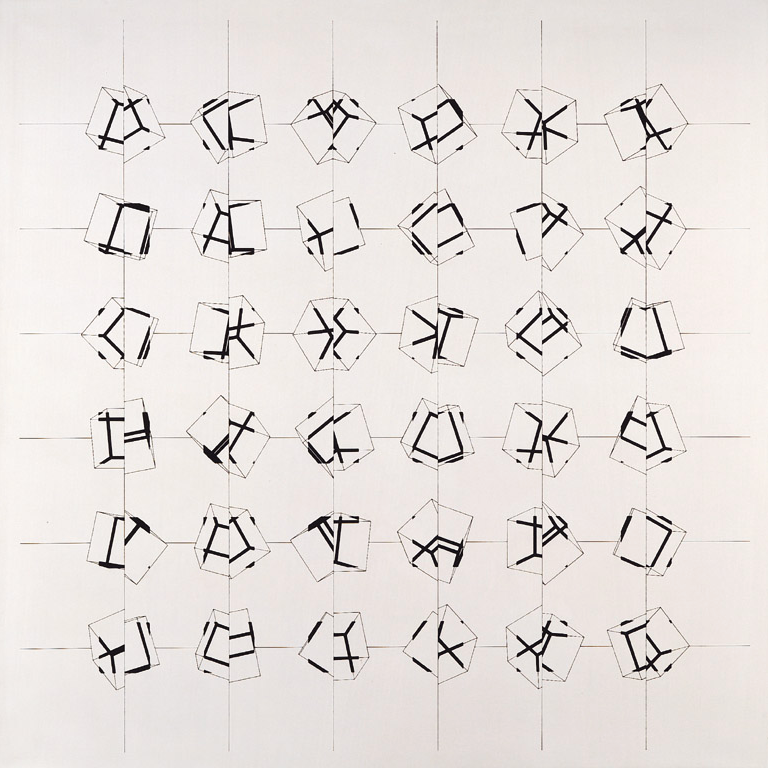

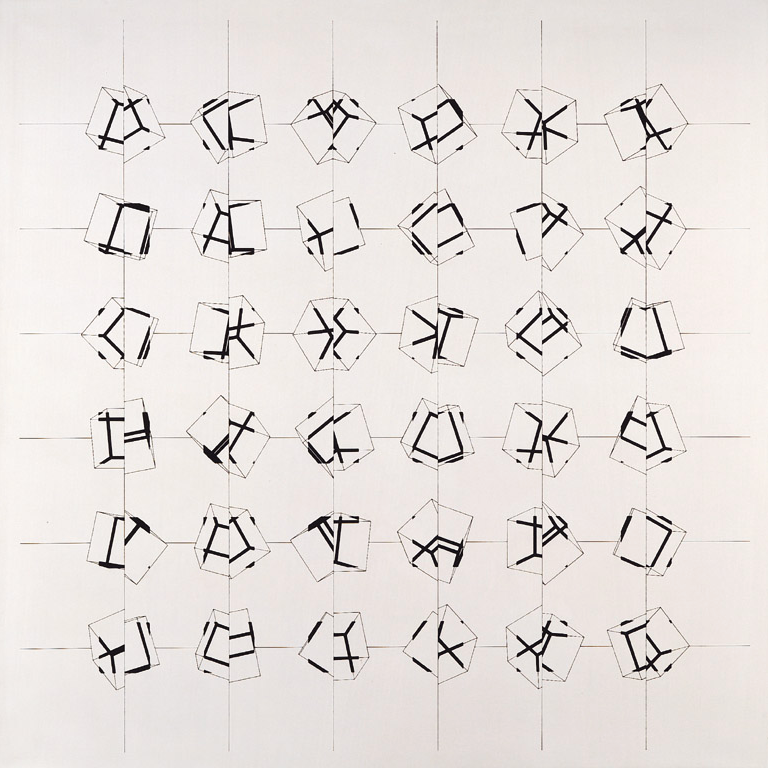

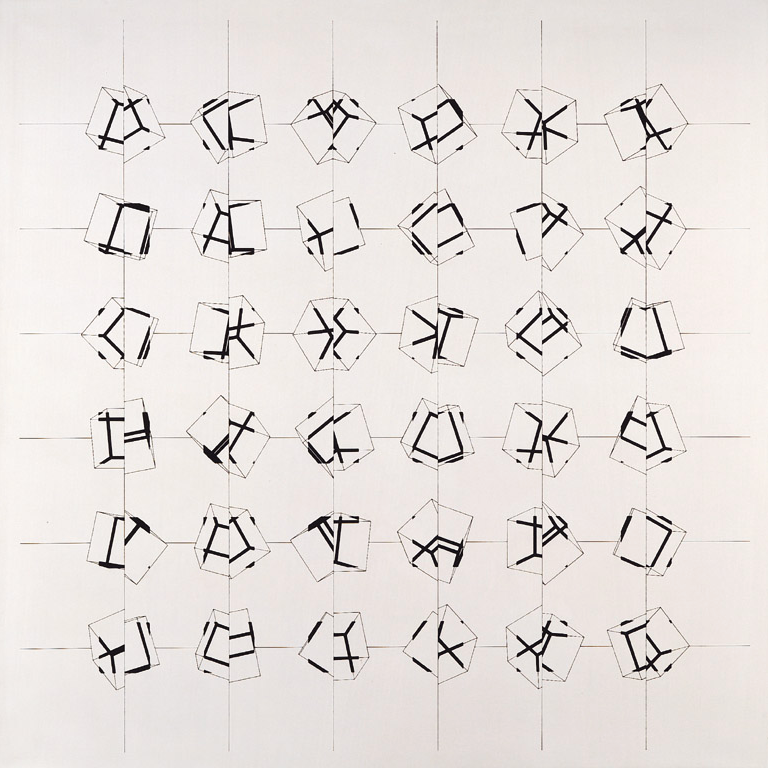

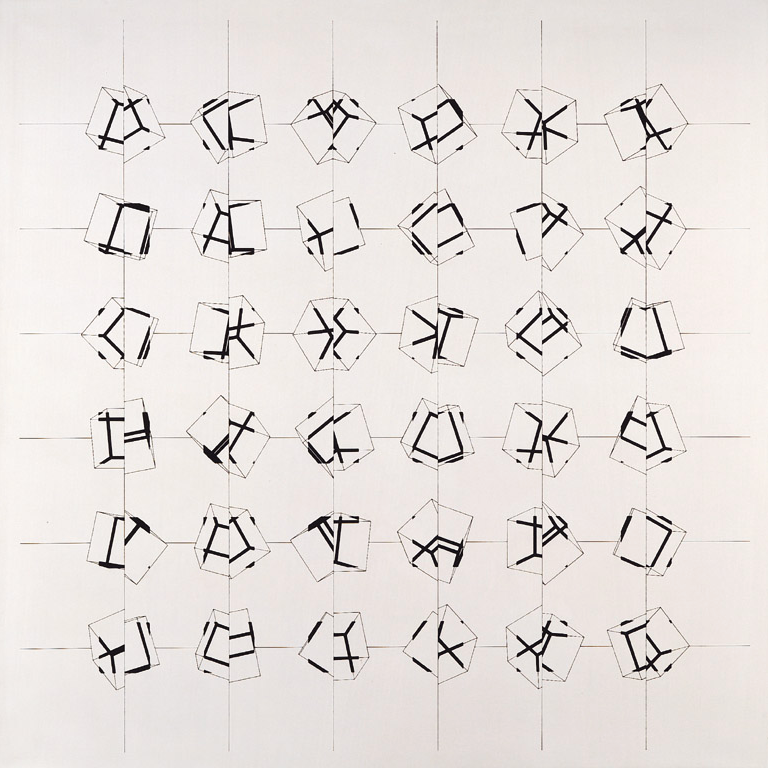

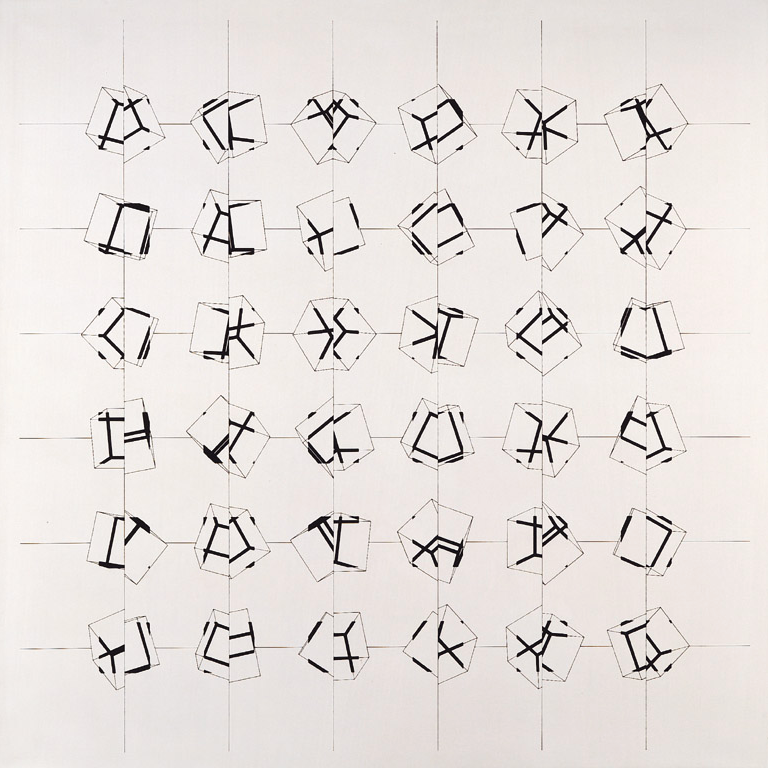

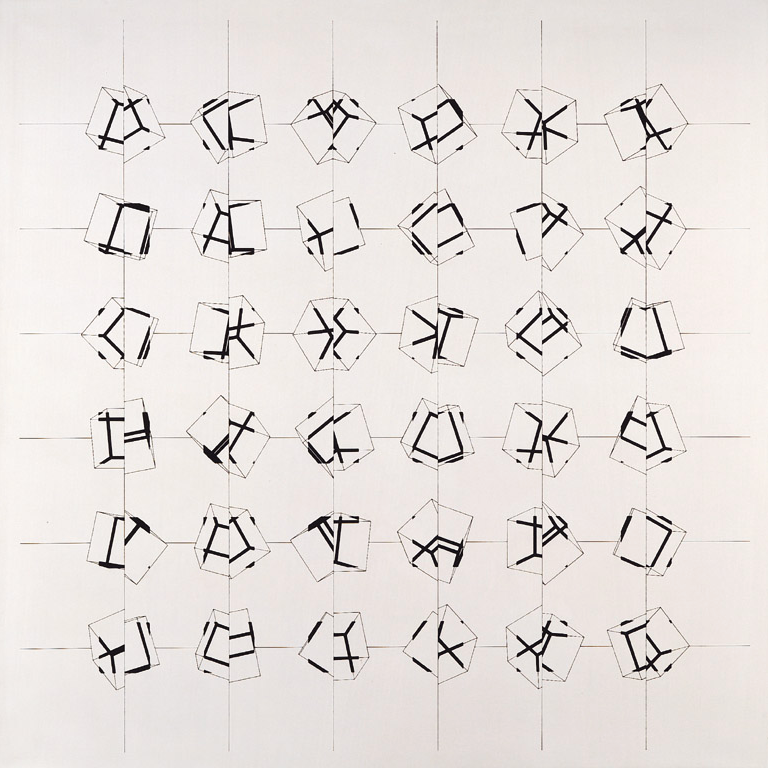

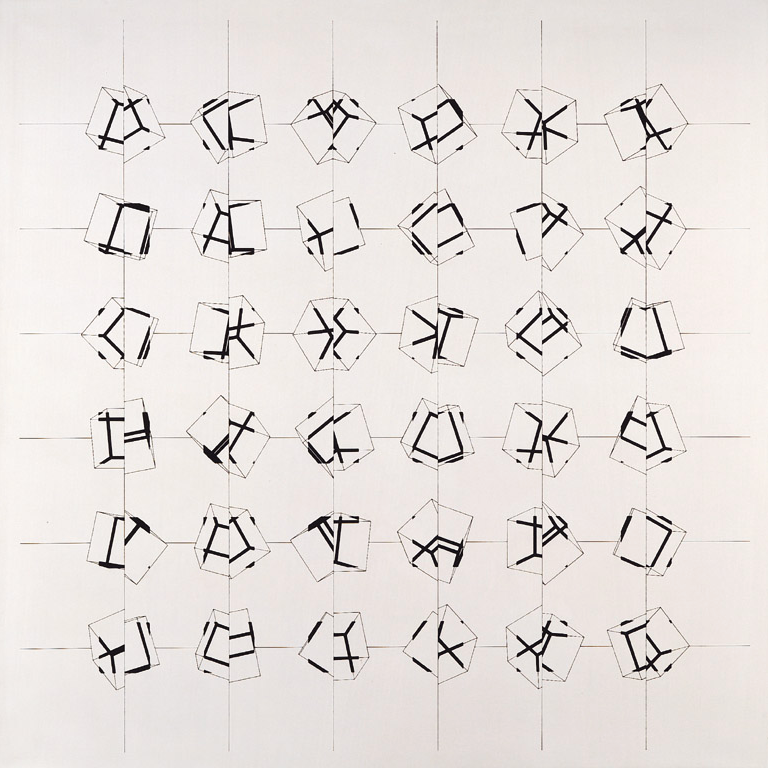

New mathematical tools can help infer financial networks from partial data to understand the propagation of distress through the network.

G. Caldarelli, A. Chessa, F. Pammolli, A. Gabrielli, M. Puliga

The science of complex networks can be usefully applied in finance, although there is limited data available with which to develop our understanding. All is not lost, however: ideas from statistical physics make it possible to reconstruct details of a financial network from partial sets of information.